Defining the ‘Invisible Hand’: A9 vs. A10

Think of A9 as Amazon’s old search engine — a keyword-and-sales-speed engine that rewarded matching and momentum. A10 is the newer, meatier version of Amazon Search: it still cares about keywords and sales, but it treats them as parts of a larger customer-behavior puzzle. The algorithm’s implicit job? Surface items that are most likely to make customers happy — fast — and in doing so, maximize Amazon’s revenue per search. This means A10 blends relevance, performance (sales & conversion), seller credibility, and outside demand signals into a single, optimization target.

The Pillar of Sales Velocity (The #1 Factor)

If you only remember one thing: sales velocity (how fast your product is selling right now, plus historical performance) is still the engine that drives placement. Amazon rewards listings that prove they will continue to sell — not just spike once. Historical sales build ranking equity; recent velocity shows momentum. Together they tell Amazon: “This will convert for other shoppers.” Without steady sales, even a perfectly optimized listing will struggle to stay on page one.

Sales History vs. Recent Velocity

Historical sales = trust bank account. Recent velocity = real-time pulse. Both matter; leaning only on one (e.g., a launch spike) produces short-lived gains.

Best ways to “seed” velocity

- Launch promos with targeted PPC and coupons.

- Use Amazon Vine or early reviewer programs when allowed.

- Drive controlled external traffic (social, email) to create organic traction.

Conversion: The Direct Signal of Success

Conversion is the currency Amazon values. It’s simple: clicks matter (CTR), but purchases matter more (CR). A9/A10 measure whether people who see and click your listing actually buy. If they do, Amazon shows the product more; if they don’t, visibility dries up.

Click-Through Rate (CTR) — your headline in search

CTR tells Amazon whether your title + main image + price grab attention in the search results. Improve CTR by testing alternate main images, clear benefit-focused titles, and competitive pricing.

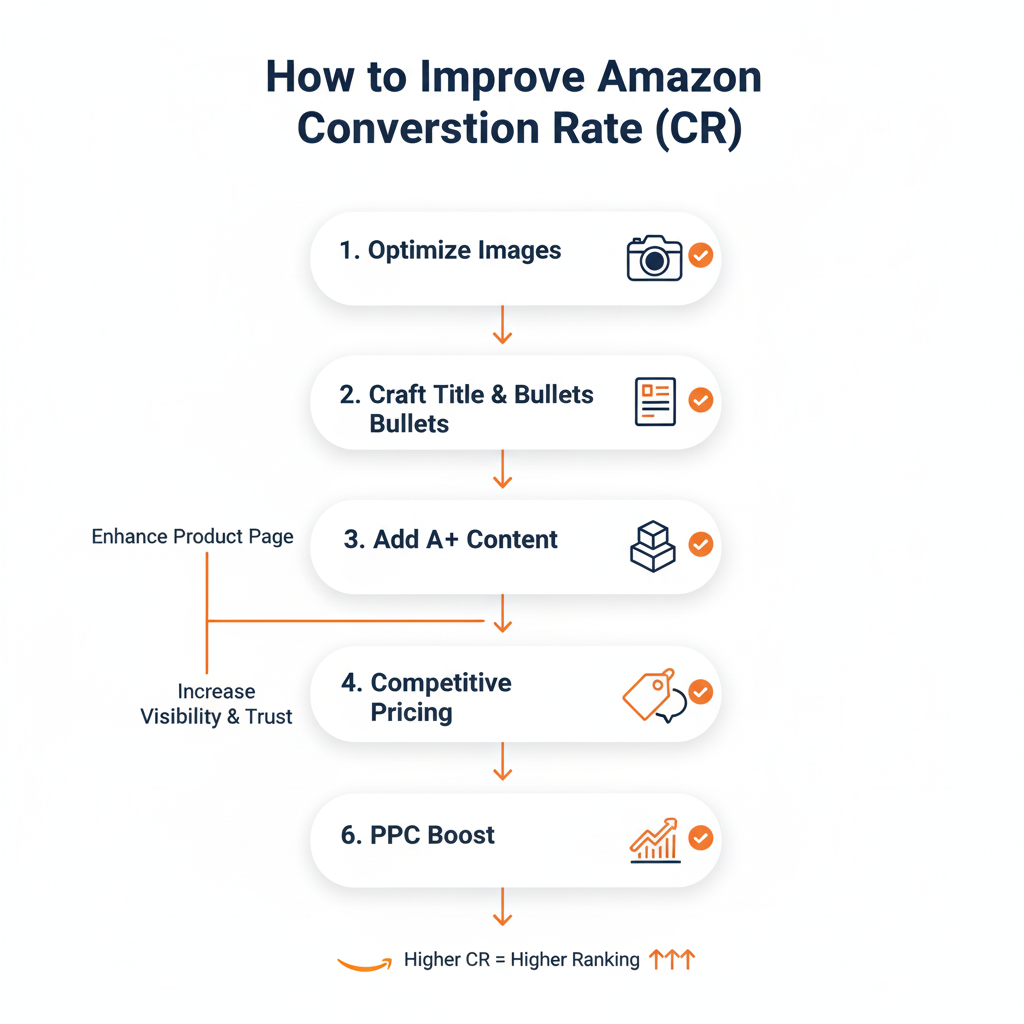

Conversion Rate (CR) — the product page’s report card

CR looks at the full page: images, bullets, descriptions, A+ content, reviews, price, and shipping expectations. High CRs are rewarded dramatically because a sale equals revenue.

On-page tests sellers should run (images, price, bullets)

- A/B test 1–2 image swaps and track CVR changes.

- Try small price experiments to find the psychological sweet spot.

- Rewrite bullets to lead with benefits, not specs.

Small lifts in CTR/CR compound quickly into higher organic rank.

Relevance: Where Keywords Still Rule

Keywords aren’t dead — they’re precise tools. A10 uses relevance to filter the candidate pool; within that pool, performance determines order. That means titles, bullets, and backend search terms still matter for being considered relevant in the first place.

Title, bullets, backend search terms — the right places

Put primary terms in the title, supporting terms in bullets, and edge/long-tail terms in backend fields. But always keep readability and buyer intent top-of-mind — Amazon penalizes listings that try to game relevance with nonsense phrase stuffing.

Semantic relevance and avoiding keyword stuffing

Use natural language and semantic variations (e.g., “wireless earbuds” vs. “Bluetooth earbuds”) rather than repeating the same phrase. Amazon’s models are smart enough to match synonyms; stuffing only makes your listing less persuasive to humans.

The Trust & Reliability Factors

Amazon is conservative with buyer experience. Several trust levers are explicit ranking signals: reviews/ratings, fulfillment method, returns & ODR, and inventory health.

Reviews, ratings and review velocity

Quality (average rating) and quantity (number of recent reviews) both influence conversion and ranking. A stream of genuine, timely reviews increases trust — and A10 places big emphasis on recent, verified signals.

Shipping, Fulfillment (FBA vs FBM) and ODR

FBA often wins because it reduces the chance of late shipments, missing parcels, and high ODRs. Amazon prefers sellers who consistently deliver a frictionless post-click experience.

Inventory depth and SKU health

Out-of-stock periods kill momentum. Maintain steady inventory, and use safety stock or replenish plans to avoid losing rank due to stockouts.

Mastering the Hidden Levers (PPC and External Traffic)

Paid ads and external demand are not silver bullets, but they’re powerful levers when used correctly.

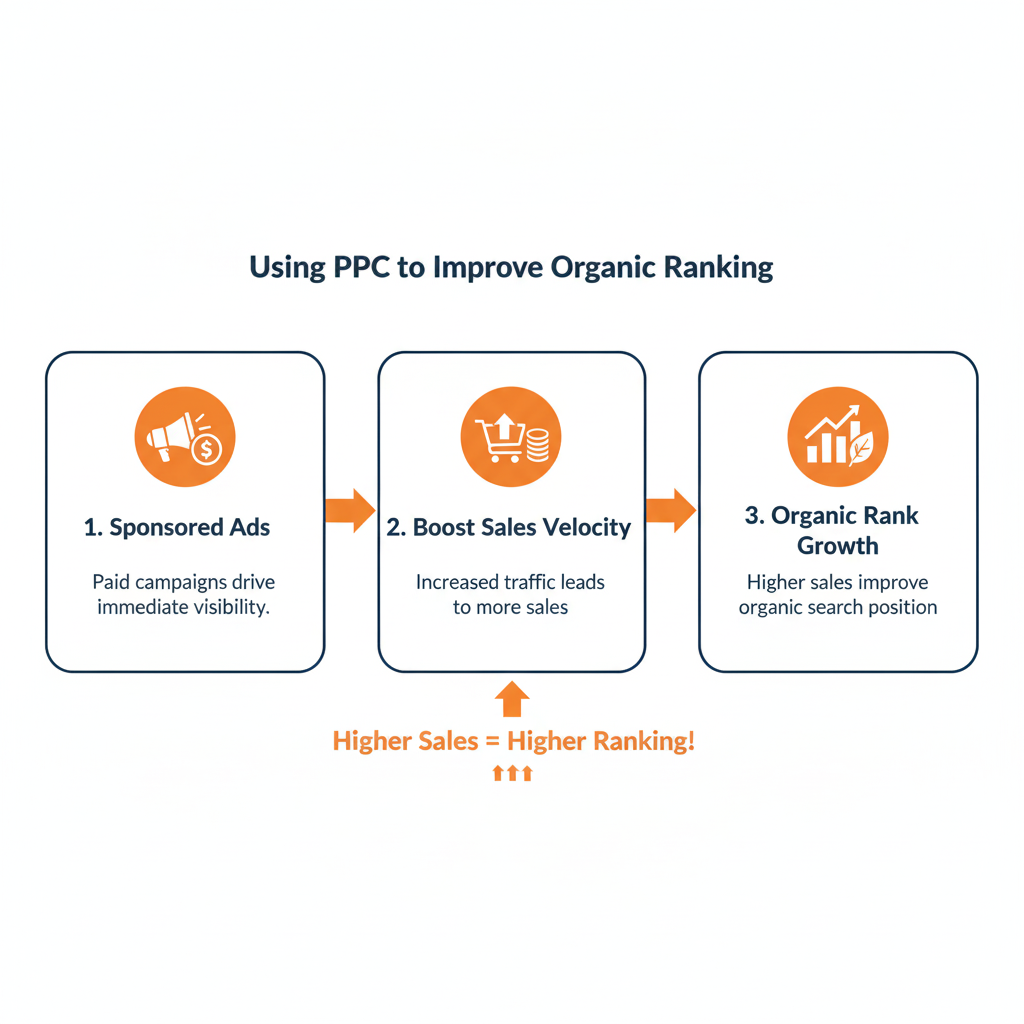

Sponsored Products: seeding vs. sustaining rank

PPC is excellent to seed rank — push impressions, get initial clicks, and accelerate sales velocity. But long-term rank depends on organic conversion and repeatability; ads alone cannot permanently replace strong organic metrics.

External traffic: social, email, influencers

A10 has been shown to pick up signals from off-Amazon demand (referral traffic, sales driven from outside). Smart sellers use influencer posts, email blasts, and content marketing to send qualified buyers — this both increases immediate sales and signals market demand to Amazon.

Seller Authority & Long-Term Signals

A10 evaluates seller-level signals too: account health, return rates, customer service responsiveness, and fulfillment reliability. Sellers that consistently show low ODR, low cancellation rates, and good customer communication earn “authority” that can lift multiple SKUs.

Brand registry and A+ content as credibility multipliers

Registered brands can use A+/EBC content to improve conversion and time-on-page, which feeds into better ranking over time.

Account health maintenance

Track returns, complaints, and late shipment metrics regularly — these aren’t just operational headaches; they’re ranking brakes when they spike.

The “Secret Logic” Summed Up: Profit per Click & Amazon’s Goal

Amazon’s invisible hand optimizes for profit per shopper interaction. It doesn’t reward clever tricks; it rewards listings that reliably turn searches into money for Amazon. That’s why the “secret logic” appears to prefer sellers who can:

- Demonstrate consistent and repeatable sales,

- Convert clicks into purchases at scale, and

- Keep customers satisfied after the sale.

In short: show Amazon you create revenue with happy customers, and A10 will reward you.

A Practical 90-Day Optimization Playbook

Week-by-week tasks

- Week 1: Audit listing: title, images, bullets, price; fix obvious UX issues.

- Week 2: Run targeted Sponsored Product campaigns to seed conversion; set coupon/launch offers.

- Week 3–4: Drive modest external traffic (email, social) to a controlled set of SKUs.

- Month 2: Collect data, run A/B image and price tests; optimize backend keywords.

- Month 3: Scale winning creatives, increase inventory safety stock, and shift ad budget from broad to exact-match winning keywords.

Quick experiments to run right away

- Swap main image and watch CTR/CVR for 7 days.

- Lower price by 3–5% for 72 hours to test volume elasticity.

- Launch a small external traffic push via an influencer coupon link.

Common Myths That Waste Time (and Money)

- Myth: Keyword stuffing will outrank better listings. (Nope — performance beats stuffing.)

- Myth: PPC forever = organic dominance. (Seed, yes. Sustain, no.)

- Myth: Only title matters. (Title matters — but CR & seller signals rule.)

Cut through noise: focus on fundamentals — conversion, inventory, and customer experience.

Tools & Metrics You Must Track

- Metrics: CTR, CR, BSR, ACOS vs organic rank movement, ODR, return rate, review velocity.

- Tools: Listing analytics (native Seller Central), third-party rank trackers, review monitoring, and PPC analytics.

Final Checklist Before You Scale

- Listings are conversion-optimized (images, bullets, A+).

- Inventory plan avoids stockouts for 60–90 days.

- Ads seeded and organic lift observed.

- Recent reviews and ratings are healthy.

- Account health metrics are stable.

Conclusion

Amazon’s search is not magic — it’s a performance-driven, customer-centric system. The “invisible hand” behind A9 and A10 rewards sellers who reliably produce clicks that convert into happy customers and consistent revenue. Treat the algorithm like a partner that pays you for delivering predictable, frictionless commerce: improve relevance to be considered, then optimize conversion and reliability to be rewarded. Do that, and the mystery fades into a repeatable playbook.

FAQs

Q1: Is A10 just A9 with a new name?

A1: Not exactly. A10 builds on A9’s foundations (relevance and sales) but gives more weight to behavioral signals, seller authority, and external demand. It’s a shift from pure keyword-matching to a more holistic performance and trust model.

Q2: Will running more PPC ads always improve organic rank?

A2: PPC helps seed traffic and can temporarily boost rank, but long-term organic visibility requires sustained conversion and customer satisfaction. Ads are a tool — not a permanent substitute for product-market fit.

Q3: How important are external traffic sources for ranking?

A3: Increasingly important. A10 responds to outside demand signals; controlled, relevant external traffic can help build velocity and signal real market demand to Amazon.

Q4: Which matters more — reviews or conversions?

A4: Both feed the same loop. Reviews drive trust and conversion; conversion validates sales velocity. Amazon rewards listings that convert consistently — reviews accelerate that process but don’t replace poor conversion.

Q5: If my product drops in rank, what should I check first?

A5: Check inventory (stockouts), price parity, recent ad changes, account health metrics (ODR/returns), and any sudden drop in CTR/CR. Those operational issues are often the quickest explanations for rank volatility.